Table of Content

An individuals with a regular income is considered eligible. By issuing Standing Instructions to pay the loan instalments through Electronic Clearing System. Provides loan approval prior to the selection of the property.

Home loan Interest rates starts from 6.90% for women, 6.95% for Others. After feeding these values, the device starts calculating the monthly installments and gives you the results in a hassle-free manner. Just put the values straight into the tool and it will give you the results in the best way.

Home Loan Processing Fee

This is a very user-friendly tool which displays the EMI and amortization table. For a tenure of 2 years, the optimum EMI payable is Rs.2,280. For a tenure of 4 years, the optimum EMI payable is Rs.1,240.

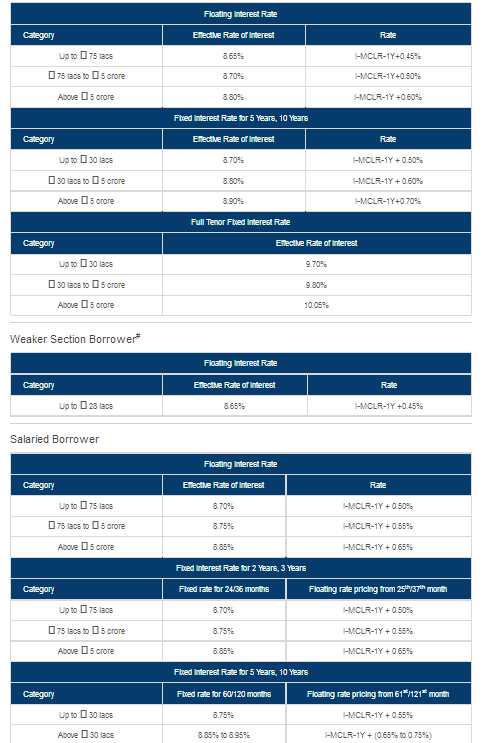

Allahabad Bank may raise interest rates in the absence for proper income proof. Allahabad is offering various Home Loans and these home loans are of various interest rates. These home loan interest rates range between 7-9 per cent. So use all these home loans in the banks that are useful. Allahabad bank is offering cheap home loans and interest rates. There are many common documents for salaried and self-employed.

Best Banks for Home Loan in India in 2022

Some of them are income documents, property-related documents. Some of the proof of address and proof of identity is also used as a common document for salaried and self-employed. Allahabad Bank links its personal loans to the 3-month MIBOR. Allahabad Bank adds a spread over the benchmark rate depending on the internal credit rating of the borrower. The amortisation schedule provides the break-up of interest and principal repayment over the entire loan tenure. I am satisfied with customer service, i did not face any inconvenience at the time of documentation .

This would include property in prime residential areas with very good resale prospects. Allahabad Bank would need to be able to sell of the property easily in case of a loan default. The NRI should have a minimum annual income that is equal to or more than INR.3 lakhs p.a. Construction of house on land pre – owned by the person. Allahabad Bank Home loan can be availed only by individuals.

Top Bank’s Home Loan Details

The Home Loan EMI Calculator determines the Home Loan repayment liability for the borrower. Thus, you are aware of your monthly obligations for a specific amount of loan at the contracted rate of interest and tenure. If you can afford a higher EMI, you can do a reverse calculation to arrive at the maximum loan amount, depending on your affordability. Calculate your home loan EMI with the Allahabad Bank home loan EMI calculator within a single click. Check EMI for different tenures, loan amount and interest rate.

Got the home loan from the INDIAN BANK around a year ago. The customer support service is good with the INDIAN BANK and they have disbursed the loan amount within10days of time. The rate of interest and the charges are low and average with the INDIAN BANK home loan services. I have applied for the home loan with the INDIAN BANK where the bank has the no proper customer support added on that the responsiveness is not good with this bank.

Allahabad Bank Personal Loan EMI Calculator

Usually, the personal loan facilities are repayable over of period of 60 months. Some of the personal loans with collateral like the AB Mortgage Loan have an extended repayment tenure up to 10 years. The ideal mode of repaying term loans in the EMI method. It’s always advised to calculate your EMI and processing fee beforehand so that you can manage your finances in a better way.

Among other financial products provided by the bank, the home loan is one of the popular ones. This scheme can be used for taking over an existing housing loans from another financial provider or banks. The loan scheme provides facility to take over the housing loan that is already existing from other finance providers or banks. Allahabad Bank accepts a prepayment at nil charges in case of floating rate home loans. When a prepayment is made, the outstanding balance of the principal amount on your home loan gets reduced. If there is a moratorium period on loan, the customer can enter the period at the space provided.

The page will also show your loan details and amortization schedule in a graph. You can receive a monthly installment at a reasonable rate of Rs.799. SBI Frequently asked questions , has listed questions and answers, all supposed to be commonly asked in context of Home Loans.

I have taken loan amount of Rs. 25 lakhs for the tenure of 20 years. Interest rate was standard around 10% for the whole year, it was a zero processing fee. In order to that, you can use BankBazaar Indian Home Loan EMI Calculator.

Your EMI shall be automatically debited at every monthly cycle’s end from the Central Bank of India account that is specified. 2 crores the deducted salary amount, after all deductions must not be greater than 70 % of the monthly income. After paying off the EMIs and other deductions, the borrower must not take back an income lesser than 70 % of the total monthly salary.

No comments:

Post a Comment